Think of business budget planning as more than just a list of numbers. It’s the strategic roadmap you build for your company's growth, guiding how you use your money and make critical financial decisions. It's really about looking ahead, forecasting your income and expenses, and managing your cash flow so you can hit your goals and handle whatever the economy throws at you.

Why Business Budget Planning Is Your Secret Weapon

I've seen too many business owners treat budgeting like a chore—a restrictive, cost-cutting exercise they have to get through. It's time to completely flip that mindset. A well-crafted budget isn't a financial straitjacket; it's a dynamic tool that empowers you to lead proactively. It's what separates the businesses that truly thrive from the ones just getting by.

This strategic document gives you the clarity to make smart decisions, especially when the market feels shaky. It helps you get a real handle on your cash flow, ensuring you have the capital ready to jump on new opportunities or navigate an unexpected downturn.

Gaining a Proactive Edge

A proactive budget gives you a serious competitive advantage. Instead of just reacting to financial problems when they pop up, you can see them coming and adjust your game plan. This forward-looking approach is what turns a simple spreadsheet into a powerful roadmap for real, sustainable growth.

Even with some economic uncertainty, the forecast for 2025 shows that leaders are getting ready to invest again after a pretty cautious 2024. According to Forrester's 2025 budget planning analysis, global decision-makers are expecting some modest budget increases. The catch? Inflation might eat into that extra cash, which makes smart, strategic spending more important than ever.

A budget is more than a list of expenses; it's a declaration of your priorities. It forces you to get intentional about how you use your resources to achieve your overarching goals.

To give you a clearer picture of what a solid budget contains, I've broken down the essential elements. These are the non-negotiables you need to build a plan that actually works.

Key Components of a Strategic Business Budget

| Component | Description | Example |

|---|---|---|

| Revenue Forecast | An educated guess of your total income, broken down by source. | Projected sales from Product A: $50,000; Service B: $25,000. |

| Fixed Costs | Consistent expenses that don't change regardless of sales volume. | Rent ($3,000/month), salaries ($15,000/month), insurance ($500/month). |

| Variable Costs | Expenses that fluctuate with your business activity and sales. | Raw materials, shipping costs, sales commissions. |

| One-Time Expenses | Irregular, significant costs that aren't part of normal operations. | New equipment purchase ($10,000), office renovation ($5,000). |

| Cash Flow Statement | Tracks the movement of cash in and out of the business over a period. | Shows if you have enough cash on hand to cover immediate expenses. |

| Profit & Loss | Summarizes revenues, costs, and expenses to show your net profit or loss. | Total Revenue - Total Expenses = Net Profit. |

Having these components locked down is what allows you to confidently put money where it will make the biggest difference. The benefits you'll see are tangible and almost immediate:

- Smarter Decision-Making: With a clear financial picture, you can evaluate opportunities based on hard data, not just a gut feeling.

- Better Profitability: When you spot and control unnecessary costs, you directly improve your bottom line. It's that simple.

- Rock-Solid Financial Stability: A budget helps you build up cash reserves and manage debt, creating a vital safety net for the lean times.

- Total Strategic Alignment: It ensures that every single dollar you spend is pushing your company toward its long-term vision.

At the end of the day, effective business budget planning is the single most important thing you can do to secure your company's financial future and unlock its true potential.

Gathering Your Financial Data for Accurate Budgeting

Before you can even think about building a budget that propels your business forward, you need to get your hands dirty with the data. A budget is only as good as the numbers you feed it. That old saying, "garbage in, garbage out," isn't just a tech world cliche—it's the absolute truth in financial planning.

The goal here is to paint a complete financial picture of where your business has been. This historical data is a goldmine. It reveals everything from seasonal sales cycles to hidden spending habits and operational weak spots. You’ll want to pull at least 12 to 24 months of financial history. Honestly, the more data you have, the more trustworthy your future projections will be.

Identifying Your Core Financial Documents

Let's start by rounding up the essential documents that tell your company's financial story. Don't just download and file them away; you need to genuinely understand what each one is telling you. These reports are the bedrock of a budget you can actually count on.

You'll need to track down the following:

- Income Statements (P&L): These are your report cards on profitability. They lay out your revenues and expenses over a set period, showing you trends in sales, the cost of goods sold, and operating expenses.

- Balance Sheets: This is a snapshot in time of your company's financial health, detailing your assets, liabilities, and equity. It's how you know what your business is truly worth.

- Cash Flow Statements: This one is critical. It shows how cash actually moves through your business. It breaks down where your money is coming from and where it's going, revealing your true liquidity.

- Past Budgets and Actuals: If you’ve budgeted before, comparing those plans to what really happened is incredibly valuable. It’s the best way to spot where your previous assumptions went wrong and get better at forecasting.

Compiling a Comprehensive Data Checklist

With those core documents in hand, it’s time to drill down and pull out the specific numbers. This is where you transform high-level reports into the detailed line items that will make up your budget. I find it easiest to just open a blank spreadsheet and start cataloging everything.

A budget should be a guide, not a trap. The data gathering phase isn't about judging past decisions; it's about collecting objective facts to create a realistic plan for the future.

Organizing your data into clear categories from the start makes the whole process smoother when you move into Excel. For a really clean analysis, you might even consider creating a dedicated dashboard for your key metrics. If you're interested, we've put together a guide on how to build an Excel KPI dashboard that can help.

To make sure you don't miss anything important, use this checklist as your guide:

| Data Category | Specific Items to Gather |

|---|---|

| Revenue Streams | Sales by product/service, recurring revenue, one-time project fees, interest income. |

| Fixed Costs | Rent/mortgage, salaries, insurance premiums, software subscriptions, loan payments. |

| Variable Costs | Raw materials, sales commissions, shipping fees, hourly wages, marketing ad spend. |

| One-Time Expenses | New equipment purchases, major repairs, legal fees, software implementation costs. |

Once you have all this information gathered and organized, you've got the raw material you need. You're ready to stop looking at the past and start building a plan for the future.

Alright, you've gathered all your financial data. Now for the fun part: turning those numbers into a working budget that actually helps you run your business. Excel is the perfect place to start. It's on most computers already, it's incredibly flexible, and you definitely don't need to be a spreadsheet wizard to make it work for you. Our goal here is to create a clear, organized document for your business budget planning.

The key to a good spreadsheet is structure. Think of it like setting up a filing cabinet. You'll want separate tabs for the main components: one for a high-level budget summary, another for detailed income projections, and a third for a complete list of your expenses. This simple step keeps things from getting messy and makes your budget a hundred times easier to read and manage down the road.

Inside your expenses tab, you need to create clear categories. This is where the real insights start to appear, as you'll see exactly where every dollar is going.

Structuring Your Expense Categories

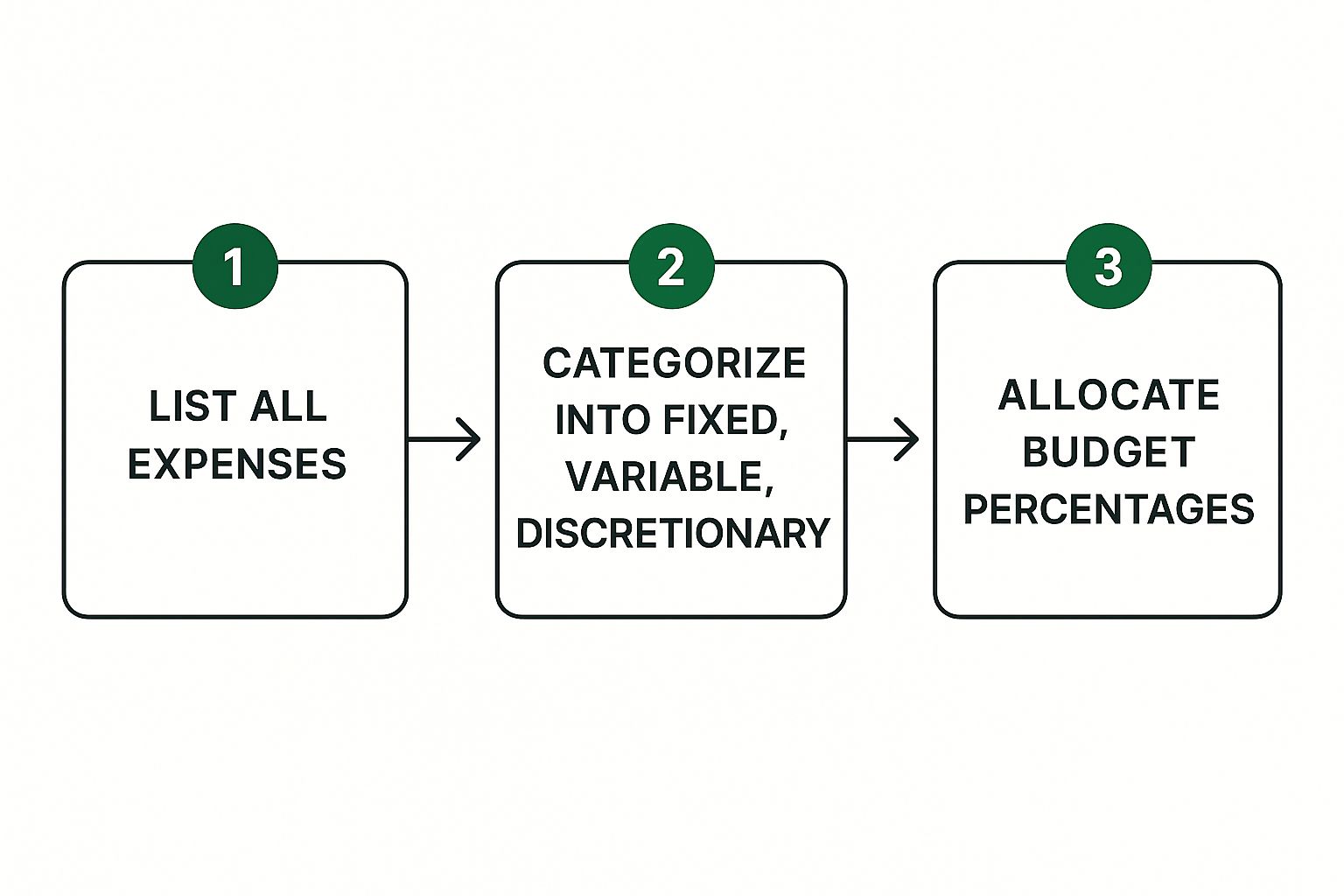

I always tell people to start by splitting expenses into three main buckets. It’s a simple system that just works.

- Fixed Costs: These are your predictable, non-negotiable expenses that stay the same month after month. Think rent for your office or shop, your salaried payroll, and those monthly software subscriptions.

- Variable Costs: These costs move up and down with your sales and operational activity. This includes things like raw materials, shipping fees, or sales commissions. The more you sell, the higher these costs will be.

- One-Time Expenses: This is your catch-all for big, non-recurring purchases. Maybe you finally bought that new piece of equipment, had a major office repair, or paid initial legal fees to get a new venture off the ground.

This simple breakdown helps you understand the core mechanics of turning raw financial data into a practical budget plan.

As you can see, the process is logical: list everything out, categorize it, and then you can start allocating your funds with confidence.

Populating Your Budget with Data

With your structure in place, it’s time to plug in your historical data. To project future numbers, you can start with some basic Excel formulas. The =SUM() function is your best friend for totaling expense categories or monthly revenue. Similarly, using =AVERAGE() on your last 12 months of a variable cost can give you a surprisingly solid baseline for your forecast.

I've seen so many people get bogged down trying to create a perfect, complex budget from day one. Don't fall into that trap. Your first goal is to get a clear, accurate picture of your finances. You can always add more detail and sophisticated formulas later.

For example, let's say your marketing spend over the last three months was $1,200, $1,500, and $1,300. You could use a simple formula like =AVERAGE(1200, 1500, 1300) to get a projected monthly marketing budget of around $1,333. It’s a far more reliable method than just picking a number that feels right.

This is the kind of clean, well-structured business budget we're aiming for in Excel.

As you fill this out, you'll see your spreadsheet evolve from a static list of numbers into a living financial tool. This is where our AI for Excel integration really shines. Instead of getting stuck writing formulas, you can simply ask the AI to "calculate total fixed costs for Q1" or "project next month's sales based on the last six months of data." It frees you up to focus on the big-picture strategy of business budget planning instead of getting lost in the technical weeds of the spreadsheet itself.

Projecting Income and Forecasting Expenses

Alright, you’ve got your budget framework laid out in Excel. Now we move from simply organizing what has happened to predicting what will happen. This is where a budget really comes to life, blending a bit of art with a lot of science. A static budget is fragile; a great budget is built around multiple possibilities.

Over the years, I've learned the hard way that a single set of numbers just doesn't cut it. That's why I swear by creating three distinct scenarios: conservative, realistic, and optimistic. Your realistic scenario is your baseline—what you genuinely expect based on current trends. The conservative plan is your "what if" for tougher times, while the optimistic one maps out your best-case potential.

Getting a Handle on Your Income Streams

Forecasting your income is much more than wishful thinking. It always starts with a deep dive into your own sales history. You’re looking for patterns, especially seasonality. If you run a retail shop, you probably see that holiday rush in Q4 followed by a quieter Q1. Pinpointing these cycles is your first step toward a believable month-to-month forecast.

But history is only part of the story. You also need to look outward at market conditions and inward at your own plans.

- Market Trends: Is your industry growing? Are new competitors popping up? Is customer demand shifting? These external forces will absolutely impact your bottom line.

- Strategic Initiatives: Planning a big marketing push? Launching a new service? These aren't just activities; they are direct inputs that should pump up your realistic and optimistic income models.

If you’re looking to get really granular with this, we have a guide that explores different sales forecasting techniques in much greater detail.

A Hard-Won Lesson: Your revenue forecast is the engine of your entire budget. If you're too optimistic, you risk running out of cash. If you're too conservative, you might miss out on smart growth opportunities. Aim for a balanced, defensible number.

Predicting Your Business Expenses

Projecting expenses follows a similar logic, combining solid data with a bit of foresight. The first thing to do is split your costs into two buckets: fixed and variable. Fixed costs like rent and insurance are usually straightforward. Variable costs, like raw materials or shipping, are trickier because they need to be tied directly to your sales forecast.

One thing I see people forget all the time is inflation. Your suppliers' prices will go up, it’s a guarantee. If a key vendor tells you their rates are increasing by 5%, that needs to go straight into your expense projections. The same goes for any big investments you have planned for the year.

This is especially critical when it comes to technology. Gartner predicts worldwide IT spending will hit a staggering $5.61 trillion in 2025—a 9.8% increase from 2024. But a lot of that "increase" is just rising prices, particularly for generative AI upgrades. You have to budget carefully just to maintain your current capabilities, let alone expand them.

This is a perfect spot for our AI for Excel integration to shine. Instead of wrestling with formulas to connect all these dots, you can simply ask the AI to do the heavy lifting. Try a prompt like, "forecast Q3 variable costs based on a 15% increase in projected sales and a 4% rise in material costs." It crunches the numbers instantly, giving you a solid, data-backed forecast without the manual headache.

How to Monitor and Adjust Your Business Budget

https://www.youtube.com/embed/3pslPbfpnzk

Alright, you've built your budget. That’s a fantastic first step, but it’s just the starting line. The real magic happens when you treat that budget as a living, breathing guide for your business—not just some file you create in January and forget about until December.

The best habit you can build around business budget planning is getting into a consistent review rhythm.

For most companies I've worked with, a monthly review is the perfect cadence. It’s frequent enough to spot problems before they turn into full-blown crises but not so often that you feel like you're drowning in spreadsheets. This monthly check-in is where you'll run a "budget vs. actual" analysis, which is the heart of smart financial management.

Conducting a Budget vs. Actual Analysis

This process is simpler than it sounds, especially in your Excel sheet. You just need to add a few columns next to your budgeted numbers: one for the actual results from the month, and another for the variance. The variance is just the gap between what you planned to happen and what really happened.

A positive variance on your revenue line? That's cause for celebration. A negative one? Time to dig in. For expenses, it's the other way around. But the goal isn't just to spot the numbers; it's to uncover the story behind them. Why was marketing spend 15% over budget? Was it because a new ad campaign absolutely crushed its goals, or did one of your ad platforms suddenly hike its prices?

Your budget isn’t a test you pass or fail. It’s a compass. When you’re off course, the goal isn’t to feel bad about it but to use the data to steer the ship back in the right direction.

Understanding these variances is where you find your biggest opportunities. As your business grows, this can get time-consuming. You can actually automate financial reporting in Excel, which is a game-changer. It frees you up to think strategically instead of getting bogged down in manual data crunching.

Making Proactive Adjustments

Once you know why the numbers are off, it's time to do something about it. Don't fall into the trap of waiting for the quarter to end. Making quick, proactive adjustments is what separates businesses that thrive from those that just survive.

Here are a few common scenarios and how to think through them:

- When you're over budget: The gut reaction is to slash and burn, but that's rarely the best move. Be surgical. Look for non-essential spending first. Can a subscription be paused? Is it time to renegotiate with a key supplier? Maybe there's a cheaper software tool that does 80% of what you need.

- When you have a surplus: This is a great problem to have! A surprise surplus is fuel for growth. You could double down on that high-performing marketing channel, pay off some debt to improve your balance sheet, or simply pad your cash reserves for a rainy day.

This cycle of monitoring and adjusting doesn't happen in a vacuum. You also need to keep an eye on the big picture. For example, major economic shifts can impact your business in ways you might not expect. The U.S. Congressional Budget Office is projecting a significant federal deficit, which can have ripple effects on interest rates and how easy it is for businesses like yours to get capital.

Staying informed on these macroeconomic trends helps you make smarter tweaks to your own budget. You can read more about these CBO projections to get a sense of how the wider economy might influence your financial strategy.

By consistently reviewing and recalibrating, your budget transforms from a static spreadsheet into your most powerful navigation tool, guiding your company toward its goals with confidence.

Answering Your Top Business Budgeting Questions

Even after you've laid the groundwork for your budget, some practical questions always seem to surface. It's completely normal. Getting these sorted out is what turns a good budget into a powerful tool for your business. Let's tackle some of the most common questions I get asked.

How Often Should I Actually Look at My Budget?

Think monthly. For most businesses, a monthly review is the sweet spot. This rhythm lets you spot any deviations between your plan and reality before they spiral out of control. It's about staying agile—comparing what you thought would happen with what actually happened each month.

Now, if you're in a very stable business where your income and costs are like clockwork, you might get away with a quarterly check-in. But for anyone in a startup, a fast-moving market, or a growth phase, that monthly review is non-negotiable. The real trick is to make it a habit. Put it on the calendar and treat it like any other critical business meeting.

A budget isn't a set of rules carved in stone; it's your financial GPS. A rigid, outdated plan can be just as damaging as having no plan at all because it leads you down the wrong path.

What's the Single Biggest Mistake People Make?

Hands down, the most common pitfall is the "set it and forget it" mindset. I've seen countless businesses spend weeks creating a beautiful, detailed budget at the beginning of the year, only to file it away and never look at it again. A budget's power isn't in its creation; it's in its use.

When you don't regularly compare your budget to your actual numbers, it becomes a useless artifact. It stops being a guide for your decisions and turns into a historical document. Another huge error is basing your entire plan on overly optimistic sales projections. That's a recipe for disaster, often leading to overspending and a cash flow crunch when reality doesn't match the rosy forecast.

How Can I Budget When My Income Is All Over the Place?

Budgeting with unpredictable income is tough, but it's essential for survival in fields like consulting, seasonal businesses, or freelance work. The secret is to build your financial plan on a rock-solid, conservative foundation.

Start by digging into your past numbers. You'll want to look at a good 12-24 months of income history to spot any patterns, identify your slow seasons, and figure out your true average earnings.

From there, you can build a smarter budget:

- Set a Baseline Budget: Base your core operating budget on your worst month's income from the past year or two. This "worst-case" approach ensures you can always cover the essentials—like rent and salaries—even when business is slow.

- Use a Tiered Spending System: Any money you make above that baseline becomes your "tier two" funds. This is what you can use for growth-related variable costs, paying down debt faster, or beefing up your savings.

- Prioritize a Cash Cushion: An emergency fund is your lifeline when income is choppy. Aim to have 3-6 months' worth of operating expenses tucked away in a savings account. This buffer lets you navigate the lean months without stress or panic.

This tiered method gives you the stability to weather the downturns and the flexibility to invest wisely when the good times roll.

Ready to stop wrestling with complex formulas and start getting instant answers from your financial data? AIForExcel integrates directly into your spreadsheet, letting you analyze trends, forecast scenarios, and build a smarter budget using simple, conversational language. Discover how AIForExcel can transform your business budget planning today.