Building an accurate discounted cash flow (DCF) model is a cornerstone of financial analysis, yet creating one from scratch is time-consuming and prone to errors. A reliable discounted cash flow Excel template streamlines this process, providing a structured framework that saves hours and ensures professional-grade results. Whether you're a financial analyst valuing a company, a project manager assessing an investment's viability, or a student tackling a case study, the right template is a critical tool for making sound, data-driven decisions.

This comprehensive guide eliminates the guesswork by reviewing the top DCF templates available today. We've analyzed each resource to provide a clear, practical overview, helping you find the perfect fit for your specific needs, skill level, and budget. Each entry includes an honest assessment of its features, pros, cons, and direct download links. Forget endless searching and vetting; this curated list provides everything you need to select a powerful template and immediately enhance your financial modeling capabilities. We will cover a range of options, from free educational resources to sophisticated premium models used by investment banking professionals, ensuring there is a solution for every user.

1. AI-powered Excel Assistant

Breaking from traditional spreadsheet templates, the AI-powered Excel Assistant from AIForExcel offers a revolutionary approach. Instead of providing a pre-built structure, it integrates an intelligent assistant directly into your Excel environment. This allows you to generate a complete discounted cash flow analysis simply by using natural language commands, effectively building a custom discounted cash flow excel template on the fly without writing a single formula.

This tool stands out by transforming how you interact with your data. You can ask it to "calculate the DCF for Project X using these cash flow projections and a discount rate of 9%" and it will generate the model for you. This dramatically lowers the technical barrier, making complex financial modeling accessible even if you aren't an Excel formula expert. Its ability to understand context and handle follow-up questions makes the analysis process conversational and highly efficient.

Key Features & Use Cases

- Natural Language Modeling: The core strength lies in its ability to interpret plain English commands to perform complex tasks. This is ideal for managers and analysts who know what they need but may struggle with the precise syntax of Excel formulas.

- Context-Aware Analysis: The AI adapts to your specific business data, understanding industry context and clarifying ambiguities. This ensures the resulting DCF model is relevant and accurate for your unique situation, whether in finance, retail, or manufacturing.

- Seamless Excel Integration: As an Excel add-in, it works within your existing workflow. There's no need to switch between applications, which streamlines the process from data input to final valuation.

- Rapid Analysis: It automates the technical aspects of building a DCF model, reducing a task that could take hours down to mere minutes. This is invaluable for professionals under tight deadlines or those needing to run multiple scenarios quickly.

Pricing & Access

The platform operates on a subscription model with plans tailored for individuals, teams, and entire enterprises. A significant advantage is the 30-day money-back guarantee, allowing you to test its capabilities risk-free. Setup is remarkably fast, taking just a couple of minutes to install the add-in.

| Pros | Cons |

|---|---|

| Builds complex financial models using natural language. | Limited to Microsoft Excel users. |

| Integrates seamlessly into the native Excel workflow. | Effectiveness depends on clean, well-organized data. |

| Dramatically reduces analysis time through automation. | May require some financial knowledge for optimal results. |

| Offers a risk-free 30-day money-back guarantee. |

Best For: Financial analysts, project managers, and business leaders who want to leverage advanced financial modeling within Excel without the steep learning curve of complex formulas.

Website: AI-for-Excel.com

2. Corporate Finance Institute (CFI)

Corporate Finance Institute (CFI) stands out as a premier educational resource for finance professionals, and its free discounted cash flow Excel template is a perfect example of its commitment to quality. Rather than just providing a file, CFI offers a comprehensive, step-by-step guide that walks users through the entire DCF modeling process. This makes it an ideal starting point for beginners or a solid refresher for experienced analysts.

The user experience is centered around learning. The template is cleanly structured and works in tandem with the instructional content, covering everything from building forecasts and calculating terminal value to discounting cash flows to their present value. While many financial reporting tasks can be streamlined, as you can discover ways to automate financial reporting, understanding the manual build of a DCF model is a crucial skill. CFI excels at teaching this foundational knowledge.

Key Features and Analysis

- Instructional Focus: The primary benefit isn't just the template itself, but the detailed educational guide that comes with it.

- Access: The template is completely free to download, although it does require a simple email registration to gain access.

- Pros: Highly detailed instructions make complex valuation concepts accessible to beginners. It's a completely free, high-quality resource.

- Cons: The only minor drawback is the necessity of providing an email address for the download.

Website: CFI DCF Model Template

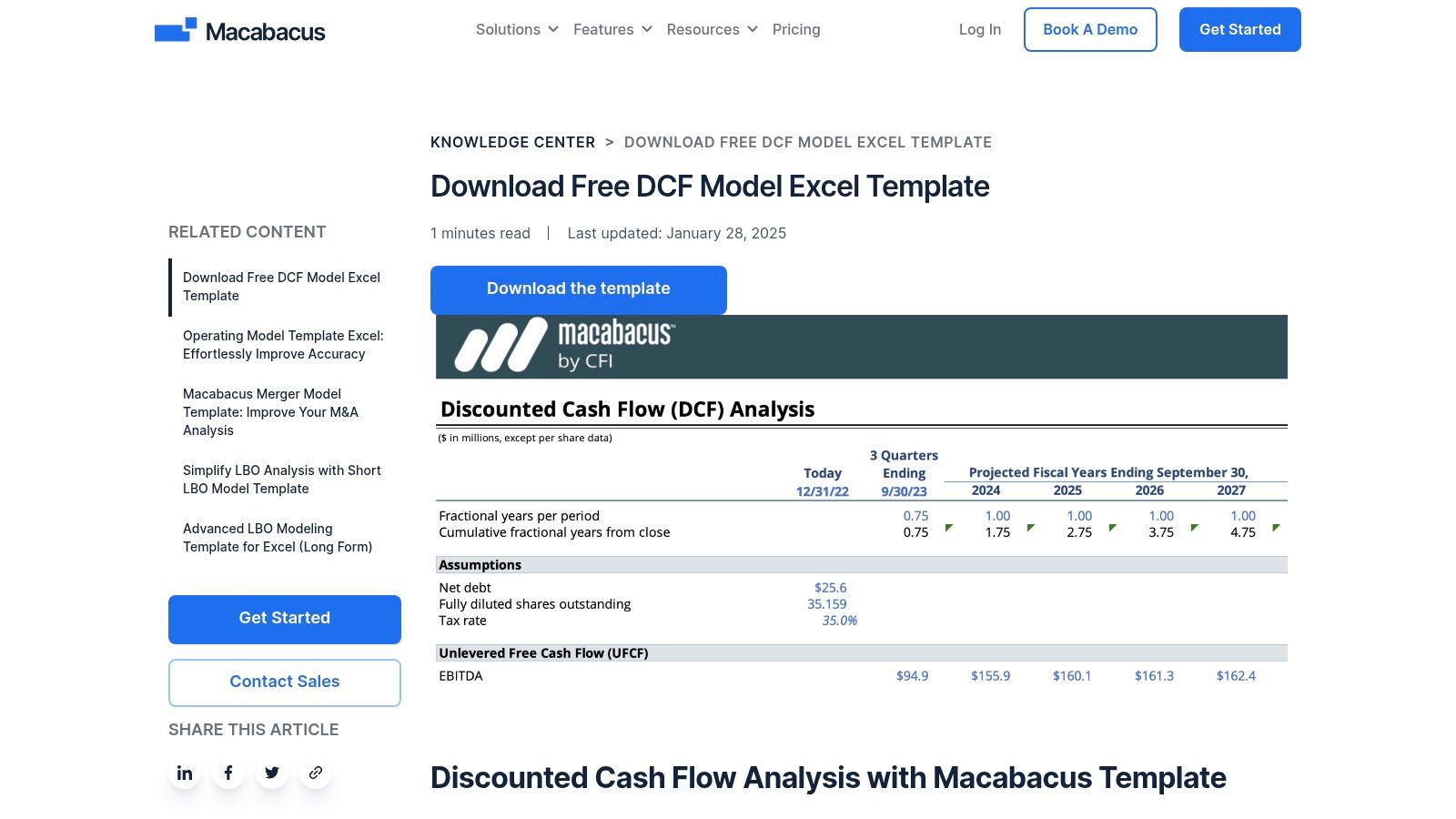

3. Macabacus

Macabacus caters to experienced finance professionals by offering a sophisticated discounted cash flow Excel template that incorporates advanced modeling techniques and best practices. This resource is designed for users who require more than a basic valuation, providing tools for detailed analysis right out of the box. It stands out for its high performance and precision, making it a go-to for serious financial modelers.

The template's user experience is geared towards efficiency and depth. A key feature is its ability to perform sensitivity analysis on terminal multiples and growth rates without relying on Excel's often-slow data tables. Instead, it employs more direct and faster methods. Furthermore, it uses XNPV formulas for manual DCF valuations, ensuring greater accuracy when dealing with cash flows that occur at irregular intervals. This level of detail makes it a powerful tool for complex scenarios.

Key Features and Analysis

- Advanced Techniques: The template is built with advanced modeling practices, ideal for professionals needing granular control and detailed outputs.

- Access: The template is free but requires signing up for a 14-day trial of the Macabacus suite to access the download.

- Pros: Highly suitable for advanced users who need robust sensitivity analysis. The use of XNPV formulas offers superior accuracy and performance.

- Cons: Access is gated behind a trial registration, which may not be ideal for users seeking a quick, no-strings-attached download.

Website: Macabacus DCF Model Template

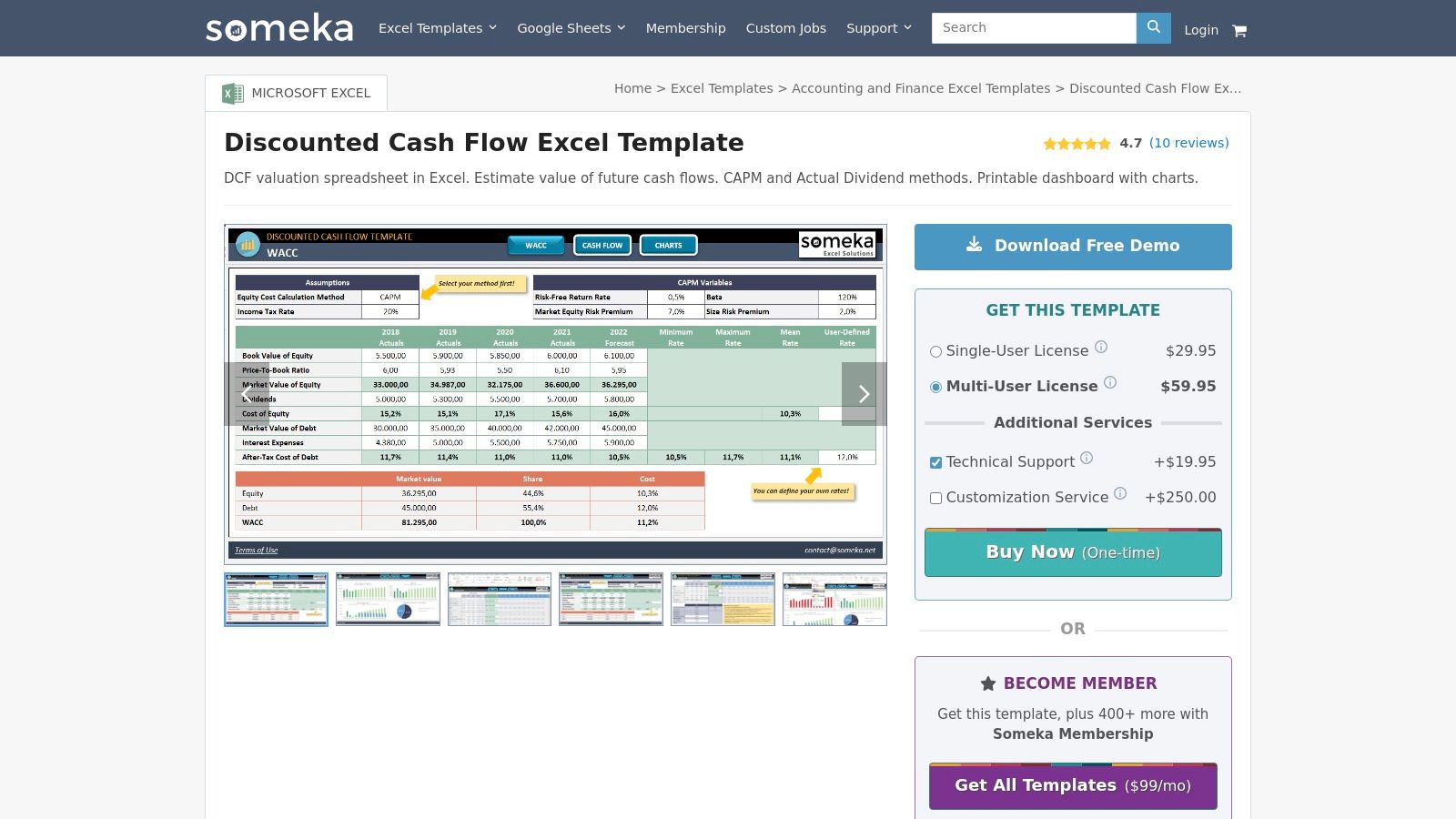

4. Someka

For those seeking a premium, feature-rich solution, Someka offers a professional discounted cash flow Excel template that emphasizes comprehensive valuation and clear visual presentation. This paid template is designed for users who want a ready-to-use tool that incorporates sophisticated methods without requiring extensive manual setup. It stands out by including both the Capital Asset Pricing Model (CAPM) and the Actual Dividend method, providing greater flexibility for different valuation scenarios.

The user experience is built around efficiency and clarity. The template features a clean, printable dashboard with dynamic charts that automatically update as you input your data, making it easy to visualize financial projections and valuation outcomes. Because the file is fully editable, users can customize it to fit specific company or project requirements. This focus on a polished, professional output makes it an excellent choice for presentations to stakeholders or clients.

Key Features and Analysis

- Valuation Methods: Supports both CAPM and the Actual Dividend method, offering more robust analysis capabilities than many free alternatives.

- Access: This is a premium template available for a one-time purchase, which grants immediate download access without any recurring fees or subscriptions.

- Pros: The built-in dashboard with visual charts is a major advantage for reporting. Its customizable nature and comprehensive approach make it a powerful tool.

- Cons: The primary drawback is that it is a paid product, which may not be suitable for users seeking a completely free resource.

Website: Someka DCF Excel Template

5. Templarket

Templarket offers a streamlined and highly focused Single Sheet DCF Excel Template, designed by Fin-Wiser Advisory for users who prioritize simplicity and speed. This template condenses the entire discounted cash flow analysis onto a single, manageable sheet. It is an excellent choice for quick valuations, academic projects, or professionals who need a straightforward model without the complexity of multi-tab workbooks.

The user experience is built around efficiency. You can easily input financial assumptions and instantly see the impact on key metrics like Free Cash Flow to Firm (FCFF), the discount rate, and the final enterprise value. This direct cause-and-effect relationship makes it a useful tool for sensitivity analysis. While this template is great for valuation, remember that robust financial modeling often starts with solid budgeting, and you can explore resources for business budget planning to strengthen your foundational inputs. Templarket’s model is perfect for those who already have their financial projections ready and need to calculate a valuation quickly.

Key Features and Analysis

- Single-Sheet Design: All inputs, calculations, and outputs are consolidated onto one sheet, making it incredibly easy to navigate and understand.

- Access: This is a premium template available for a one-time purchase, providing an affordable option for a well-structured model.

- Pros: Its simplicity is its greatest strength, offering a fast and straightforward path to valuation. The template is affordably priced for individual users or small businesses.

- Cons: The single-sheet format, while simple, may not be robust enough for highly complex or detailed financial analyses that require extensive supporting schedules.

Website: Templarket Single Sheet DCF Template

6. Wall Street Oasis (WSO)

Wall Street Oasis (WSO) is a well-known community and resource hub for finance professionals, and it delivers a highly practical, no-frills discounted cash flow Excel template. This model is designed for immediate application, functioning as a plug-and-play tool where users can input their own assumptions and figures to generate valuation outputs. Its straightforward design makes it an excellent choice for those who already understand the DCF concept and simply need a functional framework to work with.

The user experience is geared towards efficiency. The template is not just a single worksheet; it includes additional tabs for other key components of financial modeling, providing a more comprehensive tool than many other free options. This makes it a versatile discounted cash flow excel template that can be adapted for various valuation scenarios, from quick academic exercises to more detailed professional analyses. The ease of access, with no required registration, is a significant plus for users who need a quality template without any barriers.

Key Features and Analysis

- Plug-and-Play Functionality: The template is built for users to quickly enter their own numbers or formulas and see the results, minimizing setup time.

- Access: Completely free to download with no email sign-up or registration required, offering instant access.

- Pros: Very easy to use for all skill levels and includes extra tabs for more robust modeling. The no-cost, no-registration access is a major advantage.

- Cons: Unlike educational platforms, it provides limited guidance or instructional support, assuming the user has prior knowledge of DCF modeling.

Website: Wall Street Oasis DCF Model Template

7. Fin-Wiser Advisory

Fin-Wiser Advisory offers a unique take on the discounted cash flow excel template by focusing on absolute simplicity. Their Single Sheet DCF model is designed for users who want to quickly grasp the core mechanics of a valuation without getting bogged down in multiple complex tabs. The template is structured with one actual period and ten forecast periods, allowing users to input their financial assumptions and immediately see the impact on the company's intrinsic value.

The user experience is incredibly straightforward, making this a great tool for educational purposes or for quick, back-of-the-envelope calculations. It effectively calculates Free Cash Flow to the Firm (FCFF), the discount rate, terminal value, and ultimately the enterprise value, all within a single, uncluttered worksheet. This minimalist approach is perfect for beginners or for professionals who need a simple model to test different scenarios rapidly.

Key Features and Analysis

- Single-Sheet Design: The entire model is contained on one sheet, which enhances clarity and makes it easy to follow the flow of calculations.

- Access: The template is completely free to download and use directly from their website, with no registration required.

- Pros: Its simplicity makes it highly approachable and easy to understand for those new to DCF analysis. It is a completely free and instantly accessible resource.

- Cons: The single-sheet layout, while a benefit for simplicity, may limit its utility for more complex, multi-layered financial modeling scenarios.

Website: Fin-Wiser Advisory DCF Template

8. Etsy

For those seeking variety and a more bespoke feel, Etsy provides a surprising but valuable marketplace for financial tools. The platform, known for handmade crafts, also hosts a wide range of independent creators and finance professionals who design and sell their own discounted cash flow Excel template versions. This creates a diverse ecosystem where you can find everything from simple, one-page models for quick analysis to multi-sheet, highly detailed templates for complex business valuations.

The user experience is typical of Etsy: straightforward, visual, and review-driven. You can browse various designs, compare features listed by sellers, and read reviews from other buyers to gauge the quality and usability of a template before purchasing. This approach allows you to find a model that perfectly matches your specific aesthetic preferences or analytical needs, offering a level of customization not found on corporate sites. Most templates are available as instant digital downloads, providing immediate access after a small one-time payment.

Key Features and Analysis

- Wide Variety: The biggest advantage is the sheer diversity of templates available from numerous independent sellers.

- Access: Templates are typically available for instant download immediately following a one-time purchase, with prices varying by seller.

- Pros: Huge selection allows users to find a specific style or feature set. Immediate access upon purchase is convenient.

- Cons: Quality, complexity, and support can vary significantly from one seller to another. Diligence is required to vet options.

Website: Etsy Discounted Cash Flow Templates

9. Financial Edge Training

Financial Edge Training provides a practical and accessible entry point into financial modeling with its free discounted cash flow Excel template. Much like other educational platforms, its strength lies in combining a downloadable file with a clear, instructional guide. This approach is designed for users who want to not only use a template but also understand the mechanics behind each calculation, from forecasting cash flows to deriving the final enterprise and equity values.

The user experience focuses on a guided learning journey. The template is logically laid out, walking the user through each core component of a DCF analysis. It is a fantastic resource for students, junior analysts, or professionals transitioning into finance roles who need to build foundational modeling skills from the ground up. By offering a clean and user-friendly spreadsheet, Financial Edge ensures that learners can focus on the valuation concepts rather than getting lost in a complex interface.

Key Features and Analysis

- Instructional Focus: The template is supported by a comprehensive guide that breaks down the steps of DCF modeling, making it ideal for beginners.

- Access: The file is available for free download after completing a simple email registration on their website.

- Pros: The detailed, step-by-step instructions are highly beneficial for those new to valuation. It is a completely free and high-quality educational tool.

- Cons: Access is gated behind email registration, which is a minor inconvenience for some users.

Website: Financial Edge Training DCF Model Template

10. Old School Value

Old School Value champions a hands-on, fundamental approach to stock valuation, and its free discounted cash flow Excel template reflects this philosophy. The tool is intentionally designed for manual input, empowering users to take direct control over every assumption and variable in their analysis. This makes it an excellent resource for investors and students who want to truly understand the mechanics behind a DCF valuation rather than relying on automated data pulls.

The user experience is straightforward, focusing on the core components of a DCF model. It provides a clean, uncluttered spreadsheet with clear instructions embedded within, guiding you through the process of estimating a stock's fair value. This manual process forces a deeper engagement with the company's financials and helps in better understanding the key performance indicators that drive value. For those looking to dive deeper, you can explore key performance indicators examples to enhance your analysis. This template is ideal for building a strong foundational understanding of valuation.

Key Features and Analysis

- Manual Input Focus: Its core strength is the emphasis on manual data entry, which fosters a deeper understanding of the valuation inputs.

- Access: The spreadsheet is available for free but requires users to register with an email address to receive the download link.

- Pros: Perfect for learners and analysts who prefer a hands-on approach. The template is free and comes with helpful instructions.

- Cons: The need for email registration is a minor hurdle. It may be too basic for professionals seeking a more automated, feature-rich model.

Website: Old School Value DCF Spreadsheet

11. Enerpize

Enerpize offers a versatile and straightforward discounted cash flow Excel template that stands out for its flexibility. It uniquely provides versions for both Microsoft Excel and Google Sheets, catering to users regardless of their preferred spreadsheet software. This adaptability makes it a great choice for individuals or teams who operate in different digital ecosystems, allowing for seamless collaboration and accessibility.

The template is designed for a broad range of valuation needs, from standard business valuation to more specialized assessments like real estate and capital-intensive projects. It provides a clean layout for tracking cash inflows, outflows, and net cash flow before applying a discount rate. While it may not have the extensive modeling features of more complex financial modeling suites, its simplicity and direct approach make it an excellent, no-cost tool for quick and reliable valuations.

Key Features and Analysis

- Format Flexibility: The availability of both Excel and Google Sheets versions is a significant advantage for user convenience and collaboration.

- Access: The template is completely free to download directly from the website without any registration or email requirements.

- Pros: Dual-format option is a major plus. It’s ideal for various valuation types including real estate and capital projects.

- Cons: The model is relatively basic and may lack the advanced features needed for highly complex, multi-layered corporate valuations.

Website: Enerpize DCF Template

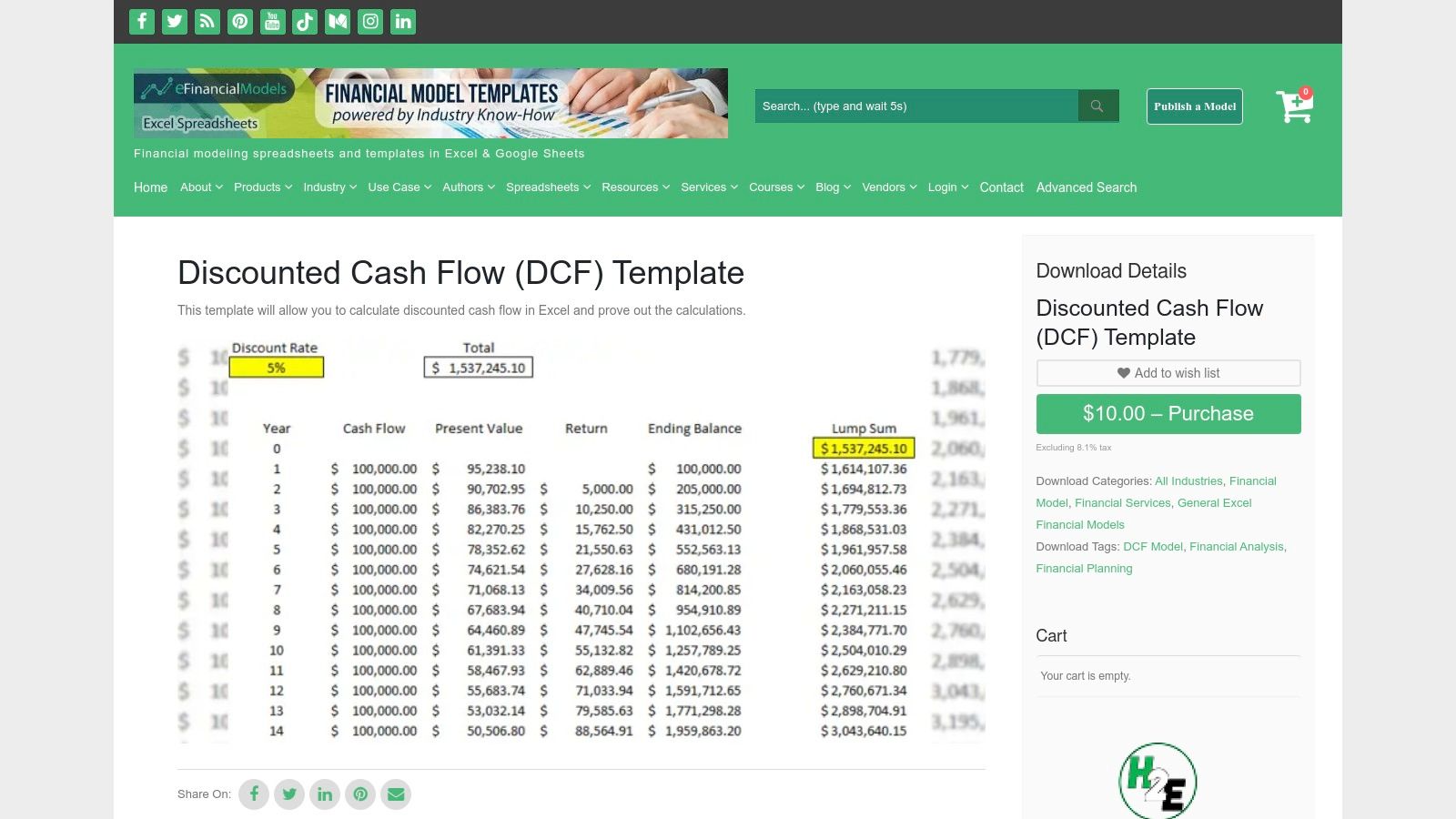

12. eFinancialModels

For those in need of a straightforward, no-frills valuation tool, eFinancialModels provides a free discounted cash flow Excel template that excels in its simplicity. This resource is designed for quick and simple valuations, allowing users to efficiently calculate the present value of annual cash flows by inputting key assumptions. It’s an ideal choice for students, entrepreneurs, or analysts who need a quick check on a company's value without the complexity of a multi-sheet, fully integrated financial model.

The user experience is built around speed and ease of use. The template features a clean layout where users can easily adjust the discount rate and cash flow projections to see the immediate impact on the valuation. While it doesn't offer the deep instructional guidance of other resources, its strength lies in its plug-and-play nature. This makes the eFinancialModels discounted cash flow excel template a handy utility to have in your financial toolkit for back-of-the-envelope calculations.

Key Features and Analysis

- Adjustable Inputs: Key drivers like the discount rate can be easily modified, providing flexibility for sensitivity analysis.

- Access: The template is completely free to download directly from the website without any registration required.

- Pros: Perfectly suited for quick, high-level valuations. It is user-friendly, completely free, and instantly accessible.

- Cons: Its functionality is limited to basic DCF calculations and may not be sufficient for in-depth, complex corporate valuations.

Website: eFinancialModels DCF Template

Discounted Cash Flow Excel Template Comparison

| Product / Provider | Core Features / Capabilities | User Experience & Quality ★ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| AI-powered Excel Assistant | Natural language AI assistant in Excel, automates complex financial analyses and multiple business functions | ★★★★★ Trusted by 4,800+ pros, fast insights | Flexible plans, 30-day money-back 🏆 | Professionals & enterprises using Excel | Context-aware AI, quick 2-min setup, adapts to follow-ups |

| Corporate Finance Institute | Free DCF Excel template + comprehensive step-by-step guide | ★★★★ Beginner-friendly, detailed instructions | Free with email registration 💰 | Beginners & learners in finance | In-depth educational guide on DCF modeling |

| Macabacus | Advanced DCF template with sensitivity analysis and XNPV formulas | ★★★★ High accuracy, suited for advanced users | Free with 14-day trial registration | Advanced financial analysts | Performance optimized, advanced modeling techniques |

| Someka | Paid comprehensive DCF template with CAPM and dividend methods | ★★★★ Customizable, printable dashboard | One-time purchase, no recurring fees 💰 | Users needing detailed valuation tool | Visual charts, multiple valuation methods |

| Templarket | Single-sheet DCF template simplifying intrinsic value calculations | ★★★★ Affordable & straightforward | Affordable one-time cost 💰 | Users preferring simple models | Single sheet design for ease, multiple intrinsic value inputs |

| Wall Street Oasis | Free plug-and-play DCF template with multiple financial tabs | ★★★★ Easy for all skill levels, no registration | Free, no registration required 💰 | Beginners & pros needing quick setup | Plug-and-play simplicity, multiple financial tabs |

| Fin-Wiser Advisory | Free single-sheet DCF with 1 actual + 10 forecast periods | ★★★★ Easy to understand and use | Free to download 💰 | Learners and simple model users | Simplified, single-sheet layout |

| Etsy | Variety of DCF Excel templates from multiple sellers | ★★★ Varies by seller & template | Varies by seller, instant download | Wide range, from beginners to pros | Large selection, instant access |

| Financial Edge Training | Free DCF template with stepwise guide on modeling | ★★★★ Detailed instructions, beginner-friendly | Free with email registration 💰 | Beginners & training participants | Educational resources combined with template |

| Old School Value | Free manual input DCF spreadsheet with clear instructions | ★★★ Hands-on experience focus | Free with email registration 💰 | Users wanting manual control | Personalized, manual valuation approach |

| Enerpize | Free Excel & Google Sheets DCF template for various assets | ★★★ Flexible format options | Free to use 💰 | Business & real estate valuers | Cross-platform (Excel & Sheets), versatile use cases |

| eFinancialModels | Simple free DCF template for quick valuations | ★★★ Basic but user-friendly | Free to download 💰 | Users needing fast, simple tools | Adjustable discount rate, straightforward use |

Final Thoughts

Navigating the world of financial modeling can feel like a high-stakes endeavor, but as we've explored, you don't have to build your valuation framework from scratch. The right discounted cash flow excel template serves as a powerful launchpad, transforming a complex, error-prone task into a streamlined and insightful process. From the comprehensive, institution-grade models offered by Macabacus and Corporate Finance Institute to the accessible, user-friendly options from Someka and Etsy, the landscape of available tools is rich and varied.

Your ideal choice hinges on a clear understanding of your specific needs, your Excel proficiency, and your budget. Are you a student or a solo analyst needing a solid, free foundation? The templates from CFI or Wall Street Oasis might be your best starting point. Are you a professional in a corporate finance role requiring robust, integrated tools with sensitivity analysis and advanced features? Investing in a premium suite like Macabacus or a specialized model from eFinancialModels will likely yield a significant return on investment through time saved and increased accuracy.

Key Takeaways and Your Next Steps

Before you download the first template you see, take a moment to reflect on the key considerations we've discussed.

- Match the Tool to the Task: A simple, single-period DCF for a small business valuation has vastly different requirements than a multi-stage model for a publicly traded company with complex debt structures. Don't over-complicate your analysis with a template that is too robust, or hamstring it with one that is too simple.

- Audit and Understand: Never treat any template as an infallible black box. Take the time to trace the formulas, understand the core assumptions, and validate the logic. This not only prevents embarrassing errors but also deepens your own financial modeling expertise. A great template is a learning tool, not just a calculator.

- Factor in Your Ecosystem: Consider how the template will integrate with your existing workflows. If you’re already using other financial modeling add-ins or have specific reporting standards, ensure your chosen template is compatible and easily adaptable.

Ultimately, selecting a discounted cash flow excel template is the first step. The real value is unlocked when you use it to challenge assumptions, run multiple scenarios, and build a compelling narrative around the numbers. The goal isn't just to arrive at a valuation; it's to understand the key drivers of that value and to communicate your findings with confidence and clarity. Use these resources to build, test, and refine your financial story.

Ready to move beyond static templates and build dynamic, custom financial models faster than ever? AIForExcel empowers you to generate complex formulas, automate data cleaning, and even create entire DCF model structures using simple text commands. Stop searching for the perfect template and start building it instantly with the power of AI by visiting AIForExcel.